BUILD CAPABILITY TO BUILD CONFIDENCE

Joe is the former CEO of a manufacturing company and one of the most confident individuals I’ve met. “I’m tired of being right,” he told me more than once. Not bragging. Venting. “Too often, someone on my team explains a result, and I tell them that doesn’t feel right, figure it out. They go off, dig into the numbers, and come back saying, Joe, you were right!”

“In the solitude of leadership, the greatest challenge is often the war within. Building confidence is a journey, not a destination.”

Confidence. We all have it. And we occasionally lose it. Confidence in others. Confidence in ourselves. It’s like the old Miller Lite commercial “Tastes Great! Less Filling!” But the voice in our head says, “You’re great, you suck!” At its worst, Imposter Syndrome sets in.

Business leaders face a unique situation. While facing their own confidence challenges, they also must worry about the confidence of other leaders, strategies, the performance of the company’s collective capabilities, and the toughest of all, the company culture. Other leaders share these responsibilities, but the person at the top owns the whole thing. A couple of unfortunate things can all trigger a crisis of confidence.

Our Confidence Level Varies In Different Situations

Confidence is the feeling or belief that we can rely on our abilities, talents, and judgment. It’s an innate self-assurance that we can succeed in any given situation.

Confidence = Experience + Knowledge + Discipline

It’s an outcome of success. Think of the sales rep who can sell snow to an Eskimo. Or the techie who can solve any problem. Or the people who thrive in chaos.

But let’s face it, not everyone exudes confidence in every situation. Networking, a new job, or a difficult technical challenge are situations that can sap our confidence. We will have different confidence levels at different times.

Senior business leaders face the widest variety of confidence struggles. Here are five that weigh heavily on anyone in the corner office:

Strategic Planning & Initiatives – Creating and leading the execution of strategies and initiatives requires confidence. Realizing the impact of marginal success on a long-term direction can create self-doubt in a leader’s ability.

Decisions Making Doubts – Consequential decisions can affect the future of the business, with success or failure dependent on factors beyond the leader's control.

Managing Uncertainty – If only the business could run on “cruise control”! The market and people are dynamic, which creates uncertainty.

Adapting to Change – Market conditions, new technology, customer sentiment, and government policies create a constant need to adapt. Leaders must recognize the need, plan, and champion change.

Financial Pressure – The pressures of managing the company's financial health can be overwhelming, especially in challenging economic times.

The Journey to Confidence is Lonely, But Leaders Are Rarely Ever Truly Alone

So, what do you do when a confidence crisis strikes? Participating in a CEO roundtable and working with a business or mindset coach can help. But the ultimate cure is building knowledge, the step to wisdom.

Knowledge is power. Your experience earned your right to sit in the chair. Demonstrated success shows what you learned about leadership and strategy, and how you’ve mastered functional and technical skills. But you didn’t do it all by yourself; you had trusted partners with you.

Lack of knowledge saps confidence. You have a leadership team on the bus with you. You have the right people in the right seat. But do you have all the right seats? If you don’t have a CFO or other financial expert, you don’t.

I previously shared a blog “Why Every Business Needs a CFO”. Besides being a trusted financial partner, the right CFO supplies a deeper insight into business drivers and how to use new information to make data-driven decisions. Knowledge is power, so let’s explore how finance can create knowledge, provide certainty, and help you make fact-based decisions.

Who Are Our Best Customers? - Do you know your customers as well as Amazon knows your partner? Finance adds a different analytical perspective to knowing customers beyond sales volume. Are they profitable customers? Where are the hidden costs associated with doing business with unfortunate customers? Which ones should you fire?

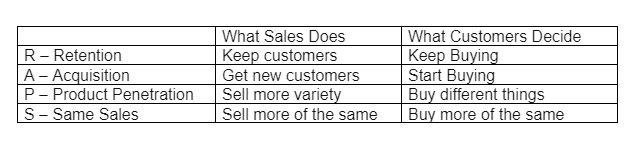

How Are We Growing? – There are only four things salespeople do daily, and they align directly with four decisions customers make. Where is your growth coming from?

Who’s Moving Our Margins? – Gross Margin % (Gross Profit / Sales) is a key indicator of sales profitability. Most margin reporting stops with what the margins are, rarely getting into ‘why’ or ‘what to do next.’ There are seven groups making decisions that affect margins. Who do you go to if you don’t know why margins are going down, or up?

Should We Change? – Change is constant, and decisions precede every change. To make good decisions, what information do you need? Whether implementing a new strategy, investing in new products, hiring more people, or implementing a new system, you should require a financial analysis of the expected range of outcomes.

Once you’ve decided to add more knowledge to your expertise, it takes discipline to instill new ways of using numbers in your business. As you get started, resist the urge to go it alone! Whether you hire a finance-focused CFO or adopt a program like the Entrepreneurial Operating System, you will immediately see changes. Hani Malek of EOS Worldwide shared with me how “EOS instills using Scorecards and Measurables to drive informed decision making vs. gut feel, ego, and emotion.”

Be Wise, Like Joe.

Joe knew his numbers. His wisdom came from years of experience leading through various business cycles, strategic initiatives, and daily operations. He liked getting into his numbers. He made it a mission to have his managers learn to analyze their own. “I’m not going to be here forever.”

Numbers are not the most fun thing for many leaders. You may not know them as well as Joe, but someone you trust really should if you want to gain more insights from your data, schedule a conversation with me here.